As The People v. Sam Bankman-Fried rages on, with the disgraced founder of FTX and shadow owner of Alameda Research facing 115 years behind bars, a lot of skeletons in the two organizations’ closet have resurfaced: and while before the most famous of crypto’s failures they might have been seen as standard, last year’s developments have cast new light around them and their potential meaning.

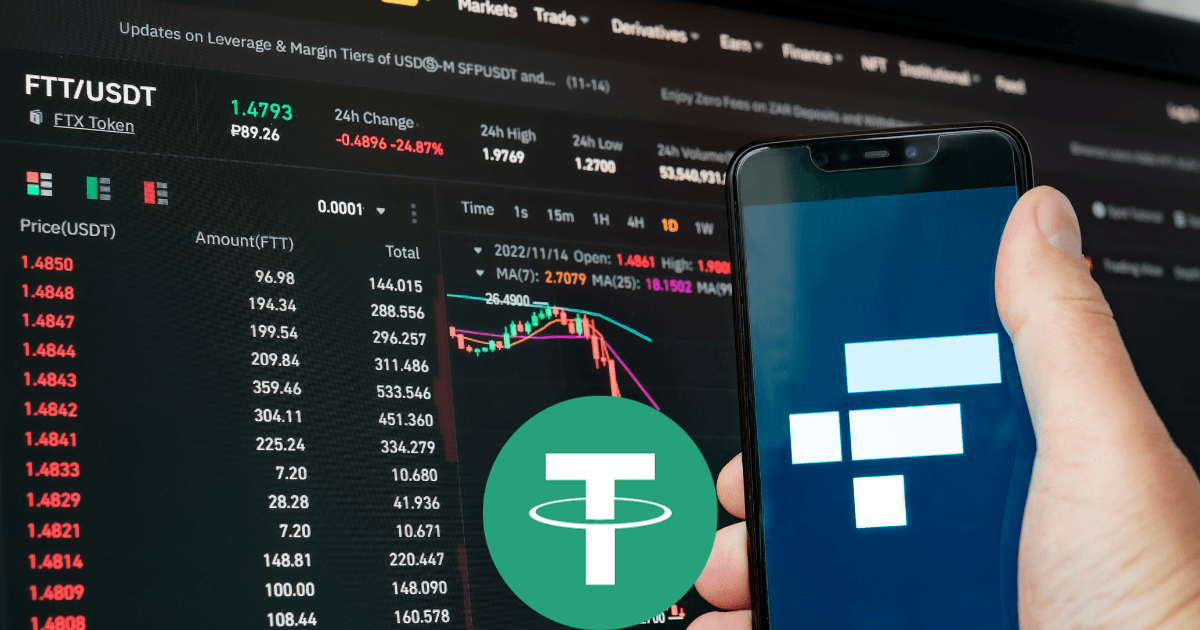

For context, in the remote off-chance that someone reading this is not up to speed with FTX and SBF; In November 2022,the FTX crypto exchange collapsed in a matter from days, after the liquidity crisis of its native token, FTT. As the firm was responsible for over a million users’ funds at the time, its bankruptcy caused a gigantic, multi-billion dollar hole in the market.

Even through SBF declared numerous times that investing firm Alameda, co-founded by him, and FTX were totally separate, investigators found that over $10BIL in customer funds were passed from FTX to Alameda, which also had a $65BIL credit allowance with the exchange. And yesterday, CoinBase director Connor Grogan rekindled the USDT-FTX fire with new findings.

Grogan’s Analysis

In a series of tweets, USDT’s minting faced on chain scrutiny once again, after crypto information firm Protos conducted their own analysis and concluded that a whopping $36.7BIL of USDT’s supply was minted by Alameda. This number seems much higher, however, with a previously unnoticed $2.85BIL traced by Grogan to various involved addresses. The complete number of $39.55BIL amounts to 47% of crypto’s biggest stablecoin circulating supply

This has naturally been viewed as concerning for USDT as a whole, as it is just the latest piece of a complex and seemingly tense puzzle; USDT is known for having avoided internal scrutiny numerous times and for its very diversified collateralization, and now that half of its minting has been traced to perhaps the most disgraced firm in the blockchain space, many fears this to signify possible illegalities and hidden agreements between these players; and by association, the ever present fear of USDT depegging and collapsing has risen once again.

The importance of Calm

This is where having a level head steps in. We are all familiar with the crypto space’s reactionary, volatile nature; while in the bull market every single positive piece of news would cause an upsurge in prices, this period of bearish consolidation and lateralization means little to no reaction to positive news, and a whole lot of reaction to Fear, Uncertainty and Doubt.

With Crypto prices already sliding because of a variety of macro concerns, the panic induced liquidity run on USDT and, USD peg notwithstanding, its potential collapse thereafter would be the catalyst of lows we probably have not seen since 2020. This is why detaching ourselves from the facade of what we’re reading is always a smart move.

While FTX and Alameda are now an example of financial irresponsibility on par with the Madoff Scandal, it is very much worth mentioning that at the time of USDT’s minting, no crypto firms, except for Binance and Coinbase, were as renowned and esteemed as the two giants. And, as the news concerns only the minting side of the stablecoin, we can comfortably presume, unless more evidence is produced, that circulation and collateralization continued as usual through solid and secure assets.

USDT has seen multiple billion dollar withdrawal periods of time, and has never left its users stranded when they desired to redeem their assets - this signifies that the depth of USDT’s reserves is undoubtedly closer to its enormous market capitalization than it is to zero, thus making it near impossible for a “Bank Run” to happen.

Did USDT know more about Alameda and FTX than the general public did at the time of these minting activities? Was the minting of nearly $40BIL USDT followed by dubious loans and credit towards Alameda? As of right now, that’s anyone’s guess. But mass hysteria with no solid evidence wouldn’t help any project, much less one responsible for so many investors’ presence in the cryptocurrency market.

Stay tuned to our Blog for everything newsworthy in the Stablecoin sector. Check our homepage for more details and follow our channels: